Understanding Bi Weekly Meaning: A Comprehensive Guide In 2024

Ramzanmughal103@gmail.com October 1, 2024 ArticleIn the world of work schedules and payments, the term “bi-weekly” can often cause confusion due to its ambiguous nature. So, what exactly is the bi weekly meaning? Is it twice a week, or does it mean every two weeks? In this article, we’ll explore the various uses of the term, clear up any confusion, and explain how it applies to payroll, budgeting, and work schedules.

What is the Bi Weekly Meaning?

At its core, the bi weekly meaning refers to something that occurs every two weeks. The term originates from the Latin “bi,” meaning two, and “weekly,” meaning once a week. Therefore, the bi weekly meaning implies that an event or action takes place every two weeks.

However, this term can sometimes cause confusion because it can be misunderstood to mean twice a week. To clarify, in standard usage, “bi weekly” primarily refers to events or activities happening once every two weeks, not twice a week. The latter would be called “semi-weekly.”

Common Uses of Bi Weekly

The bi weekly meaning is commonly used in various settings, including work schedules, payroll systems, loan payments, and personal budgeting. Below, we break down how the term applies in different contexts:

1. Bi Weekly Payroll

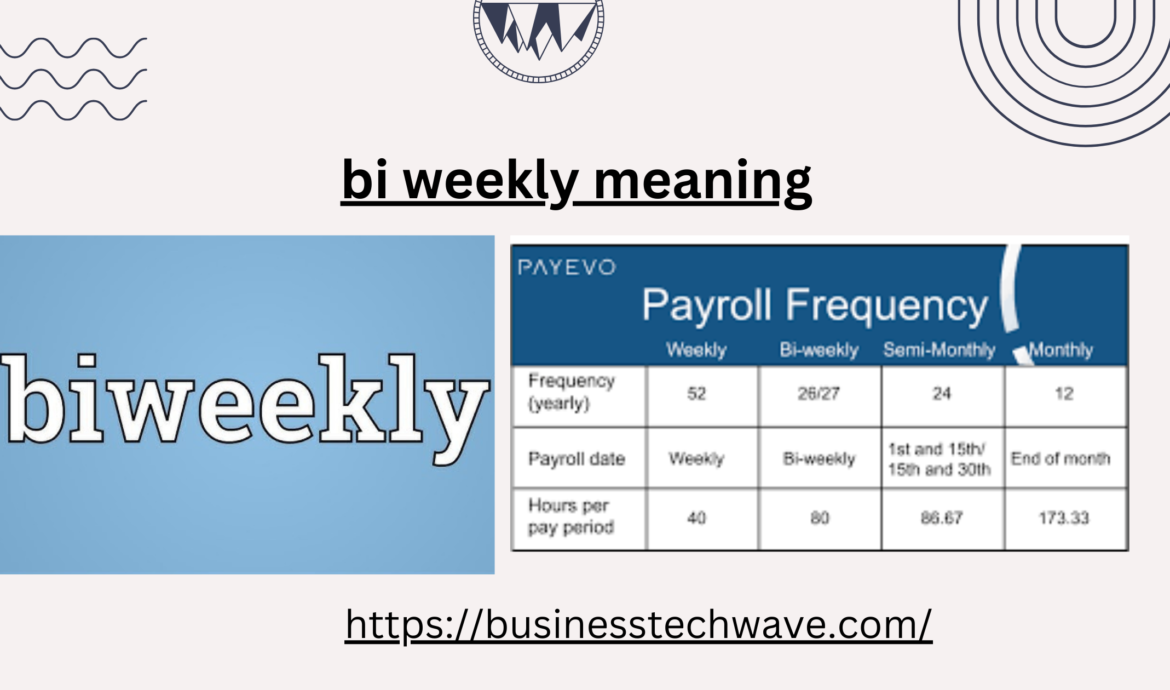

One of the most common uses of the bi weekly meaning is in payroll schedules. Many companies use a bi weekly payment system where employees receive their paychecks every two weeks. This payment schedule is popular in the United States and several other countries because it provides a predictable flow of income while allowing businesses to streamline payroll processes.

With a bi weekly payroll system, employees get paid 26 times a year (52 weeks divided by two). This system is different from a semi-monthly payroll, which occurs 24 times a year, usually on the 1st and 15th or the 15th and last day of each month.

Advantages of Bi Weekly Payroll

- Consistent Payments: Employees can plan their finances more effectively since they receive payments every two weeks.

- More Pay Periods: With 26 pay periods per year, employees receive two extra paychecks compared to a semi-monthly system.

Disadvantages of Bi Weekly Payroll

- Varying Pay Dates: Unlike semi-monthly payrolls, bi weekly payments may fall on different days of the month, which can make monthly budgeting more complex.

- Payroll Processing Costs: Companies might face slightly higher processing costs due to the increased number of pay periods.

2. Bi Weekly Budgeting

The bi weekly meaning is also relevant in personal finance and budgeting. Those who are paid bi weekly often set up bi weekly budgets to match their income schedule. This approach ensures that income and expenses are aligned, reducing the risk of overspending.

A bi weekly budget involves dividing your monthly expenses into two parts and tracking your spending based on the bi weekly meaning. For instance, if your rent is $1,200 per month, in a bi weekly budget, you would set aside $600 from each paycheck to cover that cost.

Benefits of a Bi Weekly Budget

- Easier Bill Management: A bi weekly budget allows you to distribute expenses more evenly throughout the month.

- Improved Savings: Since there are two extra pay periods in a bi weekly system, it becomes easier to set aside extra money for savings during those months.

3. Bi Weekly Loan Payments

Another area where the bi weekly meaning plays a significant role is in loan payments. Some lenders offer a bi weekly payment option for mortgages, car loans, or personal loans. Instead of making one large payment per month, borrowers make half-payments every two weeks.

This system has several advantages:

- Faster Loan Repayment: With a bi weekly payment plan, you make 26 half-payments a year, equivalent to 13 full payments. This extra payment can reduce the loan term significantly.

- Lower Interest Costs: By making payments every two weeks, you reduce the loan balance faster, which means you pay less interest over the life of the loan.

Example of a Bi Weekly Mortgage Payment

Imagine you have a 30-year mortgage with a monthly payment of $1,000. By switching to a bi weekly payment system, you would pay $500 every two weeks. Over the course of the year, this would amount to $13,000 in payments instead of the $12,000 you would pay with a monthly plan. That extra $1,000 helps reduce the principal balance, shortening the mortgage term.

Bi Weekly Work Schedules

In addition to payroll and financial planning, the bi weekly meaning applies to work schedules. A bi weekly work schedule refers to a working arrangement where employees follow a cycle that repeats every two weeks. This schedule is common in industries that require shift work, such as healthcare, retail, and manufacturing.

Types of Bi Weekly Work Schedules

- Fixed Bi Weekly Schedule: Employees work the same shifts every two weeks. For instance, an employee may work Monday through Friday during the first week and have weekends off in the second week.

- Rotating Bi Weekly Schedule: Employees rotate their shifts every two weeks. This might involve alternating between day and night shifts, or between working weekdays and weekends.

Benefits of a Bi Weekly Work Schedule

- Work-Life Balance: A bi weekly work schedule can provide more predictable time off, allowing employees to plan their personal lives better.

- Flexibility for Employers: Employers can easily rotate staff based on demand, ensuring there’s adequate coverage during peak times.

The Confusion Around Bi Weekly Meaning

While the general bi weekly meaning refers to events occurring every two weeks, there is still confusion. Some people mistakenly interpret the term as meaning twice a week. This misconception is often due to the prefix “bi-,” which can mean “two” in certain contexts, leading to the assumption that bi weekly could mean twice within a week.

To avoid confusion, it’s important to differentiate between “bi weekly” and “semi-weekly.” Here’s a quick breakdown:

- Bi Weekly Meaning: Every two weeks.

- Semi-Weekly Meaning: Twice a week.

It’s important to use the term correctly to ensure clear communication, especially in professional and financial settings where timing matters.

Bi Weekly vs. Semi-Monthly: What’s the Difference?

Many people often confuse bi weekly schedules with semi-monthly schedules. Though similar, these two terms are not interchangeable.

- Bi Weekly: Occurs every two weeks (26 pay periods per year).

- Semi-Monthly: Occurs twice a month, usually on the 15th and the last day (24 pay periods per year).

While a bi weekly meaning revolves around a consistent two-week cycle, a semi-monthly system is tied to specific dates. This distinction is especially relevant in payroll systems, where it affects how employees are paid and how businesses manage their payroll processes.

Conclusion: Understanding the Bi Weekly Meaning

In summary, the bi weekly meaning refers to an event, action, or payment occurring every two weeks. This term is widely used in payroll schedules, personal budgeting, loan payments, and work schedules. However, due to its potential for confusion, it’s crucial to use the term correctly and differentiate between bi weekly and semi-weekly or semi-monthly systems.

By grasping the bi weekly meaning, individuals and businesses can better manage their finances, optimize work schedules, and improve overall planning. Whether you’re setting up a budget, negotiating a loan repayment plan, or managing payroll, understanding the concept of bi weekly can help streamline your approach.

To summarize:

- The bi weekly meaning is every two weeks.

- Bi weekly payroll occurs 26 times a year.

- A bi weekly budget helps align expenses with income.

- Bi weekly loan payments reduce interest and shorten loan terms.

Now that you’re familiar with the bi weekly meaning, you can confidently apply it to your financial planning and work schedules, ensuring clarity and precision in your personal and professional life.

You may also like

Archives

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | |||||

| 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 10 | 11 | 12 | 13 | 14 | 15 | 16 |

| 17 | 18 | 19 | 20 | 21 | 22 | 23 |

| 24 | 25 | 26 | 27 | 28 | 29 | 30 |

| 31 | ||||||

Leave a Reply